Child Fee Tax Exemption . the government has earmarked 100 euros per month for each child under three years of age; Learn how section 80c offers deductions for education allowance,. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. qualified education expenses must be paid by: To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. all you need to know about tax benefits of children education allowance. Learn about cea rules, eligibility, taxes and procedure. 70 euros for each child between three and. You or your spouse if you file a joint return, a student you claim as a. discover tax benefits on children's education: fees charged by private schools to their pupils are currently exempt from vat under value added tax act.

from www.signnow.com

Learn how section 80c offers deductions for education allowance,. fees charged by private schools to their pupils are currently exempt from vat under value added tax act. Learn about cea rules, eligibility, taxes and procedure. all you need to know about tax benefits of children education allowance. 70 euros for each child between three and. You or your spouse if you file a joint return, a student you claim as a. the government has earmarked 100 euros per month for each child under three years of age; qualified education expenses must be paid by: this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. discover tax benefits on children's education:

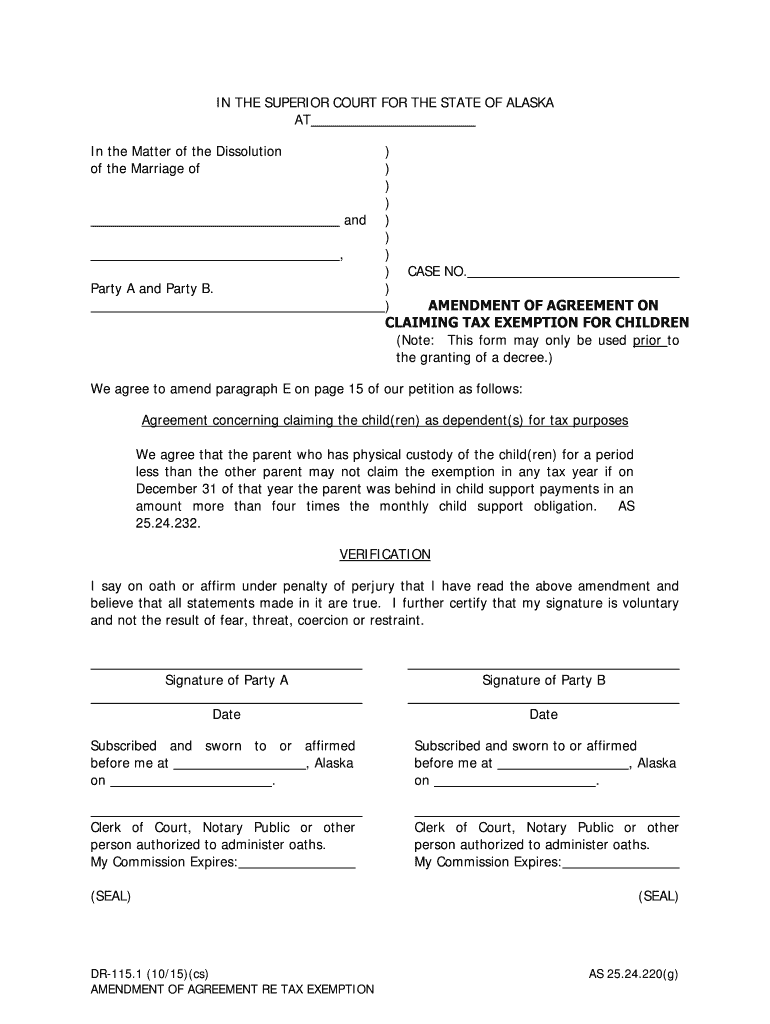

DR 115 1 Amend of Agreement on Claiming Tax Exemption for Children 10

Child Fee Tax Exemption To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. all you need to know about tax benefits of children education allowance. qualified education expenses must be paid by: discover tax benefits on children's education: 70 euros for each child between three and. Learn about cea rules, eligibility, taxes and procedure. You or your spouse if you file a joint return, a student you claim as a. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. fees charged by private schools to their pupils are currently exempt from vat under value added tax act. the government has earmarked 100 euros per month for each child under three years of age; Learn how section 80c offers deductions for education allowance,. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education.

From www.charlestonfamilylawattorney.com

Tax Exemptions for Children Dell Family Law, P.C. Child Fee Tax Exemption all you need to know about tax benefits of children education allowance. You or your spouse if you file a joint return, a student you claim as a. fees charged by private schools to their pupils are currently exempt from vat under value added tax act. qualified education expenses must be paid by: discover tax benefits. Child Fee Tax Exemption.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Child Fee Tax Exemption qualified education expenses must be paid by: You or your spouse if you file a joint return, a student you claim as a. Learn about cea rules, eligibility, taxes and procedure. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. discover tax benefits on children's education: 70 euros for each child between three. Child Fee Tax Exemption.

From saral.pro

Children Education Allowance exemption eligibility, tax benefits Child Fee Tax Exemption fees charged by private schools to their pupils are currently exempt from vat under value added tax act. the government has earmarked 100 euros per month for each child under three years of age; Learn about cea rules, eligibility, taxes and procedure. all you need to know about tax benefits of children education allowance. Learn how section. Child Fee Tax Exemption.

From www.exemptform.com

Child Exemption On Maine State Tax Form 2023 Child Fee Tax Exemption qualified education expenses must be paid by: discover tax benefits on children's education: To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. the government has earmarked 100 euros per month for each child under three years of age; this tax benefit encompasses children's education allowance, hostel expenditure allowance,. Child Fee Tax Exemption.

From www.scribd.com

Affidavit to Claim Tax Exemption for Dependent Child BIR Exemption Child Fee Tax Exemption all you need to know about tax benefits of children education allowance. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. fees charged by private schools to their pupils are currently exempt from vat under value added tax act. Learn how section 80c offers deductions for education allowance,. discover. Child Fee Tax Exemption.

From ingeborgwmicky.pages.dev

New Child Tax Credit Law For 2024 Children Dasie Emmalyn Child Fee Tax Exemption qualified education expenses must be paid by: all you need to know about tax benefits of children education allowance. Learn how section 80c offers deductions for education allowance,. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. 70 euros for each child between three and. discover tax benefits on. Child Fee Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Child Fee Tax Exemption 70 euros for each child between three and. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. Learn how section 80c offers deductions for education allowance,. Learn about cea rules, eligibility, taxes and procedure. fees charged by private schools to their pupils are currently exempt from vat under value added tax. Child Fee Tax Exemption.

From www.exemptform.com

Sales And Use Tax Certificate Of Exemption Form Child Fee Tax Exemption qualified education expenses must be paid by: 70 euros for each child between three and. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. Learn how section 80c offers deductions for education allowance,. discover tax benefits on children's education: You or your spouse if you file a joint return, a student you claim. Child Fee Tax Exemption.

From www.signnow.com

Child Tax Application Form Fill Out and Sign Printable PDF Template Child Fee Tax Exemption To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. Learn how section 80c offers deductions for education allowance,. You or your spouse if you file a joint return, a student you claim as a. 70 euros for each. Child Fee Tax Exemption.

From www.patriotsoftware.com

Child and Dependent Care Credit Reduce Your Tax Liability Child Fee Tax Exemption Learn about cea rules, eligibility, taxes and procedure. the government has earmarked 100 euros per month for each child under three years of age; 70 euros for each child between three and. this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. To qualify, you’ll need a physician’s referral proving that your child requires access. Child Fee Tax Exemption.

From fabalabse.com

Who is eligible for the Child Tax Credit in 2022? Leia aqui Can you Child Fee Tax Exemption this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. discover tax benefits on children's education: Learn about cea rules, eligibility, taxes and procedure. all you need to know about tax benefits of children education allowance. You. Child Fee Tax Exemption.

From www.cnet.com

Child Tax Credit 2024 Find Out if You're Eligible and How Much Money Child Fee Tax Exemption To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. You or your spouse if you file a joint return, a student you claim as a. 70 euros for each child between three and. qualified education expenses must be paid by: Learn how section 80c offers deductions for education allowance,. Learn about. Child Fee Tax Exemption.

From www.wikihow.com

3 Ways to Claim a Child Tax Credit wikiHow Child Fee Tax Exemption fees charged by private schools to their pupils are currently exempt from vat under value added tax act. all you need to know about tax benefits of children education allowance. You or your spouse if you file a joint return, a student you claim as a. 70 euros for each child between three and. discover tax benefits. Child Fee Tax Exemption.

From www.the-sun.com

Parents can claim up to 300 in child tax credit for kids 17 and under Child Fee Tax Exemption Learn how section 80c offers deductions for education allowance,. fees charged by private schools to their pupils are currently exempt from vat under value added tax act. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. all you need to know about tax benefits of children education allowance. qualified. Child Fee Tax Exemption.

From www.betterplace.co.in

Tax Benefits And Deductions For Expenditure On Children Child Fee Tax Exemption this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. all you need to know about tax benefits of children education allowance. Learn how section 80c offers deductions for education allowance,. 70 euros for each child between three. Child Fee Tax Exemption.

From www.formsbank.com

Fillable Form CfFsp 5220 Tuition And Fee Exemption For Students Child Fee Tax Exemption this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. You or your spouse if you file a joint return, a student you claim as a. discover tax benefits on children's education: all you need to know about tax benefits of children education allowance. Learn how section 80c offers deductions for education allowance,. 70. Child Fee Tax Exemption.

From fabalabse.com

Which parent should claim child on taxes to get more money? Leia aqui Child Fee Tax Exemption qualified education expenses must be paid by: this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. Learn about cea rules, eligibility, taxes and procedure. discover tax benefits on children's education: To qualify, you’ll need a physician’s referral proving that your child requires access to specialized private education. the government has earmarked 100. Child Fee Tax Exemption.

From nsfaslogin.co.za

Child Tax Credit 2023 What You Need to Know Child Fee Tax Exemption qualified education expenses must be paid by: Learn how section 80c offers deductions for education allowance,. the government has earmarked 100 euros per month for each child under three years of age; this tax benefit encompasses children's education allowance, hostel expenditure allowance, and deductions for. 70 euros for each child between three and. discover tax benefits. Child Fee Tax Exemption.